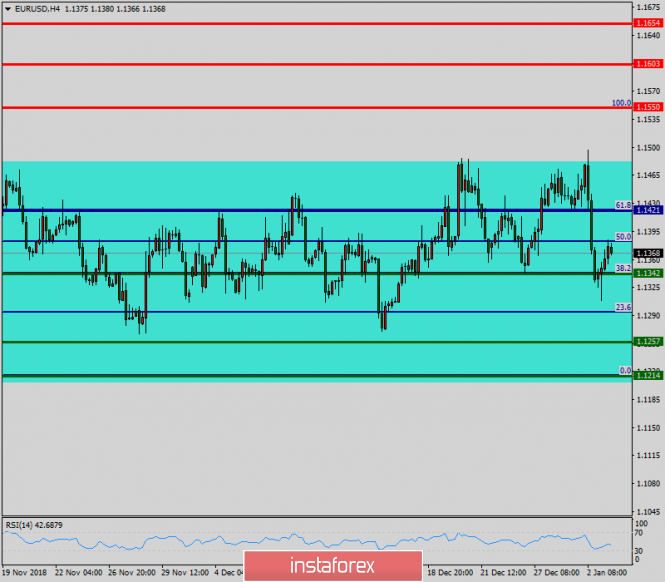

| Technical analysis for EUR/USD for January 3, 2019 2019-01-03 EUR/USD got rejected yesterday at the upper trading range boundary and pushed towards our second support level of 1.1340 after breaking below 1.14. The inability to break above 1.15 combined with the break below 1.14 is a sign of weakness. Although support at 1.13-1.1340 has held, trend remains neutral trapped inside the trading range.

Yellow rectangles - trading range Red line - major trend line resistance Green line - RSI major support trend line Gold line - RSI short-term trend line support EUR/USD got rejected at the major trend line resistance. The RSI has reached the short-term support trend line and stopped the decline. If the gold trend line RSI support fails to hold, we should expect EUR/USD to move lower or even provide a new low below 1.12 with the RSI challenging the green trend line support. If price manages to recapture 1.14-1.1430 we could see prices move towards 1.15 and higher. I prefer to be bullish at current levels with stops at 1.1260. Technical analysis for Gold for January 3, 2019 2019-01-03 Gold price remains in a bullish trend. Price made a shallow pullback yesterday from $1,288 to $1,278 and then continued to make a new higher high. There are some bearish divergence signs in the 4-hour chart but not on the Daily chart. Gold could soon make a deeper pullback but the uptrend has not finished yet.

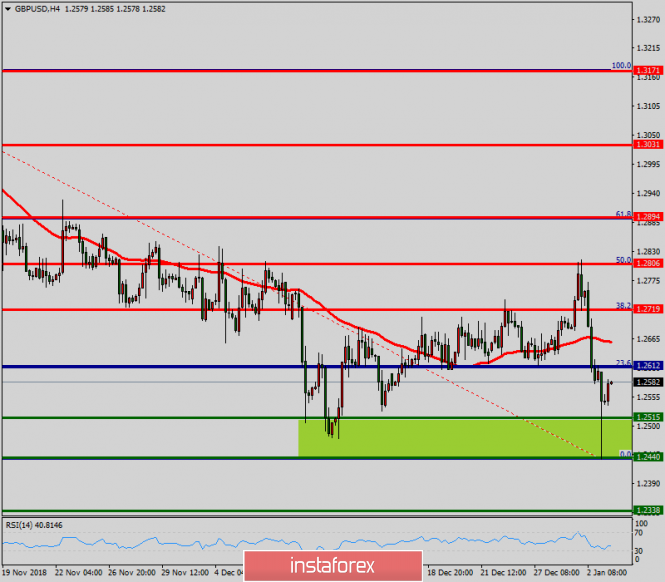

Gold line - RSI trend line support Blue line - short-term trend line support Green line - major trend line support Gold price is now trading above the 61.8% Fibonacci retracement. As long as price is above yesterday's lows, we will be expecting $1,300 to be reached. If yesterday's low at $1,278 is broken I would expect Gold price to move towards the blue trend line support and towards $1,270-65 area. There is no sign of weakening the uptrend. So far all pullbacks are considered buying opportunities. Technical analysis of GBP/USD for January 3, 2019 2019-01-03  However, if the NZD/USD pair fails to break through the resistance level of 1.2612 today, the market will decline further to 1.2440. However, if the NZD/USD pair fails to break through the resistance level of 1.2612 today, the market will decline further to 1.2440. Technical analysis of EUR/USD for January 3, 2019 2019-01-03  Overview: The EUR/USD pair continues to move upwards from the level of 1.1342. Today, the first support level is currently seen at 1.1342, and the price is moving in a bullish channel now. Furthermore, the price has been set above the strong support at the level of 1.1342, which coincides with the 61.8% Fibonacci retracement level. This support has been rejected three times confirming the uptrend. According to the previous events, we expect the EUR/USD pair to trade between 1.1342 and 1.1550. So, the support stands at 1.1342, while daily resistance is found at 1.1550. Therefore, the market is likely to show signs of a bullish trend around the spot of 1.1342. In other words, buy orders are recommended to be placed above the spot of 1.1342 with the first target at the level of 1.1550; and then towards 1.1603. However, if the EUR/USD pair fails to break through the resistance level of 1.1550 today, the market will decline further to 1.1257. EUR/USD analysis for January 03, 2019 2019-01-03

Recently, the EUR/USD pair has been trading downwards. The price tested the level of 1.1284. According to the H1 time – frame, the price is trading below the Ichimoku cloud and below the daily pivot at the 1.1387, which is a sign that sellers are in control. I also found the confirmed breakout of the triple bottom (bearish) pattern, which is another sign of the weakness. My advice is to watch for selling opportunities. The downward targets are set at the price of 1.1283 and at the price of 1.1215.

Author's today's articles: Alexandros Yfantis  Alexandros was born on September 14, 1978. He graduated from the ICMA Centre, University of Reading with the MSc in International Securities, investment and Banking in 2001. In 2000, Alexandros got the BSc in Economics and Business Finance from Brunel University, UK. In 2004, he began trading on the Greek stock market, where Alexandros got a specialization in international derivatives. Alexandros Yfantis has worked in a top financial company in Greece, responsible for the day-to-day running of the International markets department. He is a certified Portfolio Manager and a certified Derivatives Trader. Alexandros is also a contributor and analyst using Elliott wave and technical analysis of global financial markets. In 2007, he started Forex trading. He loves his profession and believes that entering a trade should always be accompanied by money management rules. His goal is to find profitable opportunities across the markets while minimizing risk and maximizing potential profit. "I'm still learning" Michelangelo Alexandros was born on September 14, 1978. He graduated from the ICMA Centre, University of Reading with the MSc in International Securities, investment and Banking in 2001. In 2000, Alexandros got the BSc in Economics and Business Finance from Brunel University, UK. In 2004, he began trading on the Greek stock market, where Alexandros got a specialization in international derivatives. Alexandros Yfantis has worked in a top financial company in Greece, responsible for the day-to-day running of the International markets department. He is a certified Portfolio Manager and a certified Derivatives Trader. Alexandros is also a contributor and analyst using Elliott wave and technical analysis of global financial markets. In 2007, he started Forex trading. He loves his profession and believes that entering a trade should always be accompanied by money management rules. His goal is to find profitable opportunities across the markets while minimizing risk and maximizing potential profit. "I'm still learning" Michelangelo Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

Alexandros Yfantis, Arief Makmur, Dean Leo, Michael Becker, Mohamed Samy, Mourad El Keddani, Petar Jacimovic, Rocky Yaman, Sebastian Seliga, Torben Melsted

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

No comments:

Post a Comment