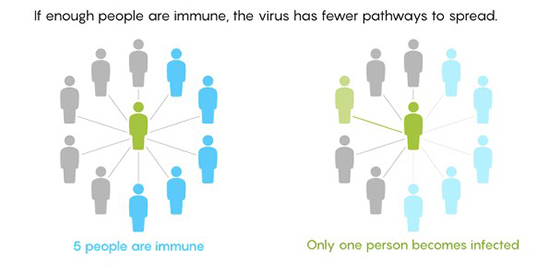

Dear Reader, Last year, any discussion of herd immunity was often met with vitriol. The ironic part is that herd immunity – and how to achieve it – is very well-established science that was first recognized as a naturally occurring phenomenon back in the 1930s. A.W. Hedrick published epidemiological research on the measles after discovering that many children had become naturally immune. Put simply, herd immunity is a threshold. It states that once a percentage of a population has achieved immunity, an epidemic/pandemic will begin to die out. It is the point at which there simply aren’t enough people without immunity to infect. It is science that has been developed over the course of nearly 100 years. There is even a general equation used to determine the threshold: 1 – 1/R0 Where R0 (R zero or R naught is the basic reproductive rate of a virus) If we assume that COVID-19 has an R0 of 2.5 (i.e., one person can infect 2.5 people on average), then the equation results in a herd immunity threshold of 60%. This means that once roughly 60% of a population has become immune through natural exposure to COVID-19, or by receiving a vaccine, then the virus’ ability to spread has been encumbered and the virus will quickly burn out. Generally, most research on COVID-19 to date indicates that herd immunity for COVID-19 is somewhere between 40 and 60%. Visually, here is a simple representation:

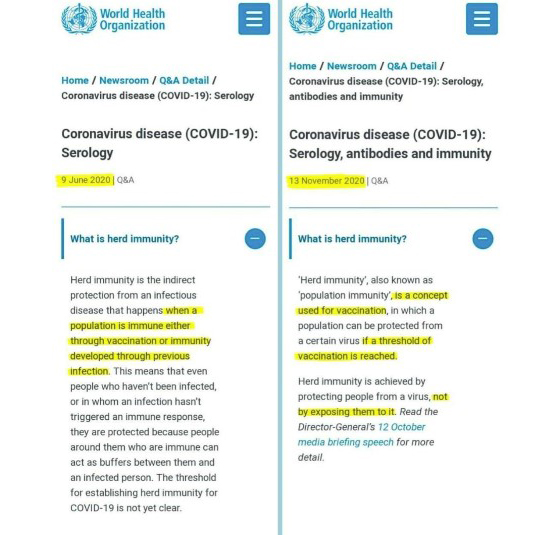

Source: Lucy Reading-Ikkanda/Quanta Magazine This is such a well-established scientific fact that a change by the World Health Organization (WHO) really caught me off guard. Due to the controversy around herd immunity, I went back in December and dug in to find out how the term was being positioned – or re-positioned. The screenshots below are taken from the WHO website. On the left side is a screenshot from June 2020. On the right side is a screenshot from November.

Source: World Health Organization The June definition of herd immunity is consistent with decades of scientific research. It acknowledges that immunity can be achieved both naturally due to prior infection as well as through vaccination. It goes further to correctly state that people who have not been infected or vaccinated are protected if those around them have already achieved immunity. But look at the November definition. Herd immunity is no longer science. It is simply a “concept used for vaccination.” And it refers only to “a threshold of vaccination” without a single mention of immunity achieved naturally. There was an uproar in epidemiology and virology circles over this chicanery when the WHO rewrote the definition of herd immunity like this. And the WHO was forced to rewrite the explanation of herd immunity once again. Here’s what it looks like: 'Herd immunity', also known as 'population immunity', is the indirect protection from an infectious disease that happens when a population is immune either through vaccination or immunity developed through previous infection. WHO supports achieving 'herd immunity' through vaccination, not by allowing a disease to spread through any segment of the population, as this would result in unnecessary cases and deaths. This is a somewhat incredulous political position for the WHO to take. After all, it is well known that for most of the population COVID-19 is far less dangerous than influenza or pneumonia. Countries like Sweden stuck to the science and allowed their economies, schools, and society to remain open, knowing that the healthy part of the population would develop immunity with less risk than influenza. But they were derided for reckless policymaking. And the WHO dug its hole even deeper when it said: Vaccines train our immune systems to create proteins that fight disease, known as ‘antibodies’, just as would happen when we are exposed to a disease but – crucially – vaccines work without making us sick. Please notice what I bolded. This comment is patently false. It is a misleading, unethical, and very dangerous statement. The Centers for Disease Control (CDC) began publishing an online database of all deaths, hospitalizations, and other effects linked to vaccines. The data is publicly available in its Vaccine Adverse Event Reporting System (VAERS). At least it was… This morning as I was researching, I was met with this:

In fact, it has been down for the last couple of days. But fortunately I take screenshots of information just in case. As of last Friday, January 22, there have been 148 deaths in the U.S. caused by the COVID-19 vaccines. There have been 170 life-threatening situations, 65 patients who are now permanently disabled, 449 hospitalizations, and 1,662 visits to the emergency room. Again, these stats are just for the U.S., and they are lagging indicators. The actual numbers are worse, but we just don’t know yet by how much. And for the most part, the current adverse events are the side effects from the first dose of the vaccines. Clinical trials demonstrated that the side effects can be more severe after the second shot. Clearly, the WHO’s comments are not giving accurate information. I’d like to reiterate what I said a couple of weeks ago. I’m providing this information because I would want to know this if our roles were reversed. This information is not to suggest at all whether or not one should take the vaccine. I simply provide information to help us all make our own personal decisions according to our own risk profiles. Now let’s turn to today’s insights… | Recommended Link | | Teeka's First-Ever IPO Tech Recommendation? Is Teeka Tiwari a millionaire-maker? Over the course of his career, he’s nailed some of the biggest calls in our industry: -

Apple in 2003, which went on to soar as much as 31,000%… -

Bitcoin in 2016, when it was trading for just $428 (which has since soared to as high as $40,000)… -

And in 2017, he recommended a little-known altcoin, which at its peak could’ve handed readers up to 151,000% gains. Each one of these bets could have helped you achieve total financial freedom. But if you didn’t land any of these big plays, don’t worry. Tomorrow, January 27th, You’ve got one more shot. | | | -- | Plaid has been set free… Visa’s $5.3 billion acquisition of Plaid fell apart. This is exactly what I was hoping for when we checked in on the deal back in November. To bring newer readers up to speed, Plaid is one of my favorite private technology companies. It is an application programming interface (API) company. APIs are basically “bridges” that allow two different software systems to communicate. And Plaid’s APIs plug into traditional banking systems. They are the “glue” between our bank accounts and the financial applications we use on our phones and computers. Consumers who have used mobile banking or mobile commerce applications have likely used Plaid’s technology and not even realized it. As a reminder, Visa’s acquisition of Plaid was announced a year ago. But a Department of Justice (DOJ) investigation had held up the deal. The DOJ’s antitrust investigation was never resolved, and the mainstream financial media are saying that’s why the deal fell through. Again, they’re wrong. Had Visa worked with the DOJ and offered a few concessions, it is likely the acquisition would have been approved. After all, Mastercard just acquired Plaid’s top competitor, Finicity, without issue in November. The real reason this deal fell apart is the team at Plaid recognized that the company had become far more valuable than the $5.3 billion Visa offered last January. As we have discussed in these pages, fintech companies providing “contactless” payment solutions have been on fire since the start of the COVID-19 pandemic. And Plaid has seen explosive growth as a result. Its technology props up e-commerce applications by enabling the key links between a software application and a consumer’s banking institution for the purpose of payment or money transfer. Plaid’s customer base has grown about 60% since Visa’s offer came in last January. And its revenues have more than doubled. What’s more, fintech companies are commanding incredible valuations in the public markets. Mobile-first commerce platform Affirm (AFRM) just went public two weeks ago. Its initial public offering (IPO) was first priced in the $20 per share range. And demand was so great that the underwriters raised the price to $49 per share ahead of the IPO date. WARNING for anyone with a 401(k) or IRA As I write, Affirm is trading around $110 per share. That gives the company an enterprise value of nearly $28 billion. Yet the company only did $276 million in revenue last year. That’s an insane EV-to-sales valuation. The bottom line is that Plaid wanted out of the deal. Its management knows that the company is worth at least twice as much as what Visa offered… and probably even more than that in this market. In fact, since the announcement of the breakup, Plaid is rumored to be planning to raise new capital at a valuation of $15 billion. And instead of being “stuck” in the clutches of a large bureaucracy like Visa, this move will keep a few options open for eventually accessing the public markets. We talked earlier this month about how companies can now do a direct listing and raise capital at the same time. That wasn’t the case at this time last year. And we know that going public via a special purpose acquisition corporation (SPAC) is also a great option today. In fact, investing in SPACs is one of our new strategies for this year. Plaid could also simply pursue a traditional IPO and likely command a lofty valuation just like Affirm. The point is, Plaid doesn’t need to sell itself short to Visa. I’m very glad the team realized this. So Plaid is officially back on our radar. This company will make a terrific investment target at some point in the near future. I can’t wait. | Recommended Link | "Sorry, U.S. taxpayer" Those are the exact words of the former U.S. government official at the epicenter of a terrible mistake. This mistake is already destroying the lives of millions. Wealthy elites – including former President Trump himself… Barack Obama… Bill Gates – all look to be moving into position to avoid the fallout. | | | | The world’s first self-driving car race… Here’s an exciting but unexpected development from the world of autonomous vehicles. On October 23, the Indianapolis Motor Speedway will host the world’s first driverless Indy car race. This will be the first official self-driving car race in history. The race will feature 39 teams from 14 different countries. The teams must develop their own self-driving software, and they will compete for a prize purse of $1.5 million. May the best self-driving car win! It will be a 20-lap race. That’s about 50 miles. And the cars are expected to reach speeds of up to 200 miles per hour. Think about that – 39 self-driving cars roaring around the track at 200 mph. That will be a major stress test for self-driving technology. I certainly plan to tune in. University Teams in the Indy Autonomous Challenge

Source: Autoweek To me, this is an indication of how fast self-driving technology is advancing. In fact, I set aside some time last week to test out Tesla’s fully autonomous driving software. To do this, I rented a Tesla Model 3 with the latest self-driving software and let it drive me around South Florida. The No. 1 Tech Stock of 2021 And what I found was that on the highway and on “simple” streets, the driver doesn’t have to do much of anything. The Tesla does all the work. This includes keeping up with the flow of traffic, changing lanes, and stopping at stop signs and red lights. It’s pretty remarkable. The only thing I had to do was touch the steering wheel every 30 seconds to let the car know that I was paying attention as a “safety driver.” And that is only because I did not have access to Tesla’s new beta software, which we talked about in November. So we are going to start seeing more and more self-driving cars on the road this year. And this driverless Indy car race suggests that we will likely see the technology used in new forms of entertainment as well. Self-driving car races are fairly obvious. We get all of the excitement and no risk at all to human life. I can also envision gladiator-like autonomous robots competing in challenges like these. Will Tether become untethered? We’ll wrap up today with a big story in the digital asset space. Tether (USDT) is the most widely-used U.S. dollar stablecoin in the world. As I write, Tether’s market capitalization is nearly $25 billion. Because Tether is backed one-to-one with U.S. dollars, many traders and institutional funds use it to trade in and out of digital assets like bitcoin and ether. Moving into USDT allows them to “park” capital in cash without having to move back into fiat currency, which is an expensive process. But a New York court case just revealed that Tether is not backed one-to-one by U.S. dollars as it claims. As of April 30, 2020, Tether was only backed 74% by cash and short-term securities. How can that be? For every USDT token that Tether issues, it is supposed to add $1 in cash to its reserves to maintain 100% backing. But Tether does not conduct regular audits to prove that it has been doing this. As it turns out, Tether has been speculating in bitcoin. It has essentially leveraged its assets into an aggressive trade rather than adding more dollars to its reserves. This is potentially a dangerous situation. We now know that Tether hasn’t been doing what it is supposed to do. But because it doesn’t conduct regular audits, we have no way of knowing where its backing is at any given time. If Tether’s backing continues to fall, USDT could become “untethered” and no longer trade for $1. That would defeat the entire purpose of the stablecoin. And it would lead to a tremendous lack of confidence and, very likely, increased regulatory scrutiny in the blockchain space. That would be very bad for the industry. It reminds me of Man Financial, the giant derivatives and commodities brokerage firm that went bankrupt in 2011. As it turned out, the company siphoned off more than $700 million from customer accounts to speculate in the markets. Clearly, things did not end well. While Tether isn’t a broker, its credibility and value are tied directly to whether or not there is in fact $1 behind every tether issued. Tether likely has enough assets to cover the value for every tether issued. But just like Man Financial, if it gets too speculative, it will be like a house of cards. Regards, Jeff Brown

Editor, The Bleeding Edge P.S. Tomorrow night at 8 p.m. ET, our friend and colleague Teeka Tiwari is hosting a special event. He too predicts that 2021 will be a record year for IPOs… And if investors can identify the right IPOs to invest in, he believes they could achieve life-changing profits. But many IPOs are overhyped and could delay investors’ wealth for decades. That’s why Teeka has developed his “blueprint” for choosing the right opportunities. If any readers would like to learn more about his method, you can go right here to reserve your spot for his event tomorrow night.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

In Case You Missed It… Tech scholar shares new tech stock pick He graduated from Purdue University's highly demanding Aeronautical and Astronautical Engineering program. He studied at Stanford, Yale, and MIT. Plus he's spent two decades as an executive in Japan, working for microchip companies. Now he's found the next great tech investment – on the verge of a profit explosion. He will tell you the name of the most important technology company in the world. And give you the ticker symbol. Watch this explosive new video here.

|

No comments:

Post a Comment