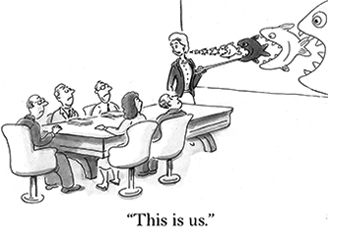

Study after study shows that most investors fail to beat the market. Not only that, but by giving into the mantra of buying high and panicking out at a low, their returns would be better with a simple passive investment in an index fund.

| You're receiving this email because you are subscribed to Trading Tips,

if you no longer wish to receive these emails you can unsubscribe here. |  |  |  | |

|  |  Good morning. Study after study shows that most investors fail to beat the market. Not only that, but by giving into the mantra of buying high and panicking out at a low, their returns would be better with a simple passive investment in an index fund. Good morning. Study after study shows that most investors fail to beat the market. Not only that, but by giving into the mantra of buying high and panicking out at a low, their returns would be better with a simple passive investment in an index fund.

One new study shows just how bad this underperformance is. It's taken until now for the average investor to get back to breakeven from the financial crisis over 10 years ago. Even though stocks got back to their pre-market crash back in 2013. The culprit? Selling in a panic, and taking their time to wade back in. To beat the market, investors have to first master their psychology.

| |  | |  |  |

|  |  |  | DOW 29,232.19 | -0.56% |  | |  | S&P 3,370.29 | -0.29% |  | |  | NASDAQ 9,732.74 | +0.02% |  | |  | | *As of market close |  | | • | Stocks dropped after the long President's Day weekend, as tech giant Apple warned on coronavirus fears impacting production. |  | | • | Oil rose 0.1 percent, , closing at $52.12. |  | | • | Gold prices soared 1.14 percent, hitting $1,604.50. |  | | • | Cryptocurrencies rose heavily, with Bitcoin rising 4.3 percent to $10,102. | | |  | | | | |

|  | | Two Stocks Offering Investors a Potential Grand Slam |  |  |  | Markets tend to go up far more than they go down. In fact, throughout history, nearly 5 percent of all trading days are at all-time highs for markets.

Many expect a correction though, and prophecies can be self-fulfilling. Stocks take a long time to climb, and when they fall, they do so quickly.

But smaller companies, or those with a catalyst to move higher, can do well in any market environment.

» FULL STORY |  | | |  |

|  | Insider Trading Reports: Western Union (WU) |  |  |  | Jan Siegmund, a director at Western Union (WU), recently started a stake in the company. She bought 10,000 shares, which came to a cost of just over $262,000.

This marks the first insider buy at the company going back three years, to early 2017.

Insider data for the past few years shows regular and recurring sales of shares by insiders. This includes both directors and C-suite employees. The selling volume peaked in late 2018.

» FULL STORY |  | | |  |

|  | Unusual Options Activity: Paypal (PYPL) |  |  |  | February 28th $123 call options on Paypal (PYPL) recently saw a 44-fold rise in volume. Over 7,010 contracts traded against a prior open interest of 161.

The bet, expiring in 10 days, is right at-the-money, given a recent share price of $122.99. It should move dollar-for-dollar upward with shares, less the time premium.

The buyer of these options paid about $2.00 each, so shares will need to hit $125 by the end of the month to profit.

» FULL STORY |  | | |  |

|  | • | Global dividends hit a record $1.4 trillion in 2019, although the growth rate slowed. |  |  |  | • | Investor interest in both stocks and bonds could be fueling a 'twin bubble.' |  |  |  | • | Traders expect bond rates to go lower, as the global slowdown, fueled by the coronavirus, continues. |  |  |  | • | Investors have also been betting on the big tech names, already leading the market, to continue higher. |  |  |  | • | Plunging solar panel costs are putting the clean tech on cost with coal. |  |  |  | • | Pier 1 files for Chapter 11 bankruptcy, with plans to close up to 450 locations. |  |  |  | • | Dairy Farmers of America agrees to buy Dean Foods for $425 million. |  |  |  | • | Google is winding down Google Station, a wireless program at railway stations in India. |  |  |  | • | Jeff Bezos uses Instagram to announce a $10 billion fund to fight climate change. |  |  |  | • | In earnings, Enbridge misses on both earnings and revenues. | |  |  |  | • | Transocean adds $366 million to its backlog, now up to $10.2 billion. | |  |  |

|  | | | TOP |  | | LDOS | 9.228% |  |  | | BEN | 6.938% |  |  | | AAP | 6.153% |  |  | | KR | 5.243% |  |  | | WAR | 3.842% |  |  | | BOTTOM |  | | VMC | 6.668% |  |  | | CAG | 6.149% |  |  | | BKR | 4.868% |  |  | | MHK | 4.754% |  |  | | LRCX | 4.114% |  |  | |  |

|  |  |  | | While the current belief is that such declines are no longer a possibility, due to Central Bank interventions, we had two 50% declines just since the turn of the century. The cause was different, but the result was the same. The next major market decline will be fueled by the massive levels of corporate debt, underfunded pensions, and evaporation of 'stock buybacks,' which have accounted for almost 100% of net purchases since 2018. |  | - Lance Roberts, founder at RealInvestmentAdvice.com, on why traders should price in the prospect of a major market decline in the future, rather than assume that markets will always rebound quickly.  |  |

|

No comments:

Post a Comment