Options traders reached their most bullish in 5.5 years, as measured by trading volume on the ISE and CBOE, the two largest options exchanges.

| You're receiving this email because you are subscribed to Trading Tips,

if you no longer wish to receive these emails you can unsubscribe here. |  |  |  | |

|  |  Good morning. Options traders reached their most bullish in 5.5 years, as measured by trading volume on the ISE and CBOE, the two largest options exchanges. Good morning. Options traders reached their most bullish in 5.5 years, as measured by trading volume on the ISE and CBOE, the two largest options exchanges.

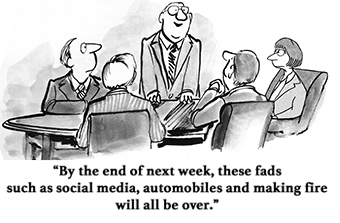

The overall level of bullish volume suggests that traders expect the market's current and strong uptrend to continue. History shows the danger of that kind of extrapolation. While we've enjoyed the market's recent gains as much as anyone else, slowdowns can and do happen. We still love options trades, but we're always on the lookout to profit and not get blindsided. Stay optimistic, but cautious.

| |  | |  |  |

|  |  |  | DOW 28,992.41 | -0.78% |  | |  | S&P 3,337.75 | -1.05% |  | |  | NASDAQ 9,576.59 | -1.79% |  | |  | | *As of market close |  | | • | Stocks dropped into the weekend, on a drop in housing starts and a slow business activity report. |  | | • | Oil dropped 0.8 percent, closing at $53.46. |  | | • | Gold rose 1.6 percent, hitting $1,645. |  | | • | Cryptocurrencies rose, with Bitcoin rising 0.6 percent to $9,661. | | |  | | | | |

|  | | Two Marijuana Stocks to Buy as the Sector Bottoms |  |  |  | Every few years, one sector tends to beat the pants off the market. Then, it dies off just as quickly as it rose.

The cannabis space has been one such sector. It's repeatedly hot… but just as often, it's out of favor.

For the past few years, it's been out of favor. Yet shares are showing signs of a sector bottoming. While there may not be a huge rally soon, the worst seems to be over.

» FULL STORY |  | | |  |

|  | Insider Trading Reports: NextEra Energy (NEE) |  |  |  | David Porges, a director at NextEra Energy (NEE), recently bought 3,000 shares. This increased his total stake to 3,655 shares for a total increase of 458 percent. The buy total purchase price came to just over $826,000.

Insider data at the company shows that this is the first buy not just in 2020, but in the past three years.

Over the past three years, company insiders have been regular and consistent sellers.

» FULL STORY |  | | |  |

|  | Unusual Options Activity: Barrick Gold (GOLD) |  |  |  | March 27th $22 call options on Barrick Gold (GOLD) saw a 32-fold rise in volume lately, going from 103 open contracts to nearly 3,300.

The bet, expiring in 32 days, will move in-the-money if shares rise just over $1.15 from their current price, or about 5.5 percent higher.

The buyer of the options also paid about $0.38, or $38 per contract to make the trade. They'll need to see shares move 7.3 percent higher in the next month.

» FULL STORY |  | | |  |

|  | | | TOP |  | | DA | 6.995% |  |  | | GILD | 4.03% |  |  | | MOS | 3.898% |  |  | | PKG | 3.29% |  |  | | NEM | 2.786% |  |  | | BOTTOM |  | | HAS | 9.011% |  |  | | AMD | 6.967% |  |  | | DVN | 5.327% |  |  | | SCHW | 4.92% |  |  | | NVDA | 4.739% |  |  | |  |

|  |  |  | | This market is just moving on momentum and, at this point, it's priced close to perfection. At this point, if we start seeing anything negative, it will probably force some people to start taking profits. |  | - Christian Fromhertz, CEO of The Tribeca Trade Group, on why the market may start to see some wild swings or even a selloff soon.  |  |

|

No comments:

Post a Comment