Miami the First U.S. Bubble to Burst?

Harry Dent | October 02, 2019 | Earlier this week I read a great article by Kuppy at Adventures In Capitalism. It brought back memories of the last condo and real estate bubble in Miami… I was there. I was moving to Tampa and sold before the crash that I was nearly alone in forecasting in late 2005. Kuppy noted that prices had plateaued for a few years and had begun to drop 20% to 35% in South Beach – and worse in the downtown Brickell area. He talks to a friend who makes non-traditional loans against these condos, and he says "it's about to blow… just give it six to nine months." Miami is Bubble City. It's a part-time vacation town for many, a show-off place that's big on laundering money into real estate from drug dealers in South America and so on. At night most are empty with no lights on, even in season. Builders get on a roll at $300 per sq. ft. costs, selling for $700,000+. So, they keep building until it blows. I was there a year ago and saw more than twice as many cranes as at the last top in 2005-6. Most buyers put 20% or less down and don't even have to come up with the rest until completion. They borrow, and borrow more if needed as the prices rise. But when they stagnate or fall, they quickly get into trouble… It's the carrying costs that average 4% to 7% before financing. The property taxes are 2% alone – I know because I paid that. You Could Stand to Lose Everything  There is no more ignoring it… our entire country has reached a critical tipping point. And, when it's forced over the edge, we could experience the largest economic decline since the Great Depression. That's why investors are getting complete access to the little-known investment research presented at the 2019 Irrational Economic Summit. Claim your Livestream Pass today. There is no more ignoring it… our entire country has reached a critical tipping point. And, when it's forced over the edge, we could experience the largest economic decline since the Great Depression. That's why investors are getting complete access to the little-known investment research presented at the 2019 Irrational Economic Summit. Claim your Livestream Pass today.

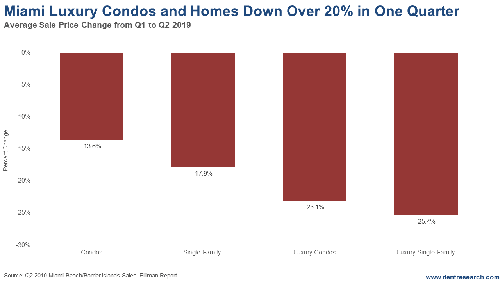

| When people start to default, the non-traditional lenders add penalty interest and the banks refuse to lend further after prices start to drop. Builders just keep adding inventory to a glut as it pays them short term to complete. Finally, the lenders start to panic and force fire sales. Miami was the biggest bubble crash in the last real estate bust, averaging 52%. It will be higher this time. The market is dominated by even higher "faker luxury" condos. Larger with more flamboyant features. Those are the hardest to unload when prices drop, says Kuppy's lending friend. This chart shows how much prices dropped between Q1 and Q2 this year… what?

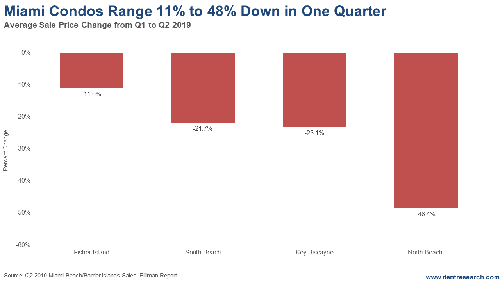

The broader market for condos fell 13.6%, homes 17.9%. But as is happening around the world from Sydney to London to Manhattan, the high-end market is leading. Luxury condos are down 23.1% and homes 25.4%. The next chart shows the range for condos in the Miami area. The worst drop was North Beach at a whopping 48.4%. Fisher Island dropped the least at 11.0%. But it was already down starting in Q2 2018 and is down 24% cumulatively from the top. South Beach came in the middle at 21.7%. Going back to Q2 2018, Key Biscayne condos are down 37.2%.

All it takes is one prominent market to have a crash to get investors spooked and lenders downright paranoid. Based on the "crane indicator" alone, Miami does look like the first major market to blow… and many more will follow. Do you want to wait and see… and hope you get lucky? Real estate and lending get tight fast! And to my Australia subscribers: Don't follow the crowd there that thinks your sharp correction is over and it's time to buy. You are the "lead dog" in this global crash, like the U.S. was last time.

Harry Dent Trending Stories... I'm tired of the impeachment talk and it hasn't really started yet. With the House working on impeachment inquiries in several committees, we'll get a healthy dose of political doublespeak from everyone involved for at least the rest of this year. It's already started to crowd other stories out of the news cycle. But we... Speaker of the House Nancy Pelosi sucked all the legislative air out of the room when she formally announced an impeachment inquiry against President Trump. The charge, of course, is based on a whistleblower's allegations. This is not an impeachment proceeding, which requires a vote on the floor of the House of Representatives and directs... We woke up today to find the markets in a critical place. Bitcoin has had a big fallout, the flashing lights are blinking. All the signs that we could be headed for a big fall are in effect. But there are a few current events ongoing that the markets don't seem to be accounting for... I predicted in 1988 forward that the massive Baby Boom generation would peak in its spending by late 2007. Simply that 46-year lag for peak spending of the average household. That happened on cue and we've been living off of accelerating QE and now tax cuts ever since to compensate. So, with such a natural... In our 5 Day Forecast last Monday for Boom & Bust subscribers, I highlighted two scenarios – one for stocks and one for Bitcoin – that looked imminent to break up or down sharply. Well on Tuesday, Bitcoin made its break down out of a large triangle pattern that was coming to a make or... |

No comments:

Post a Comment