Bonds Do As Well As Stocks Throughout History

Harry Dent | October 07, 2019 | I just saw an interesting study by Edward McQuarrie that has a lot to do with last Monday's 5 Day Forecast about Treasury Bonds being the last great bubble. This study says that outside of 40 years, bonds have done about as well as stocks in total inflation-adjusted returns, all the way back to 1797. That's almost all of America's history as a country and a stock exchange… Wow? Why not just buy more bonds in the future!

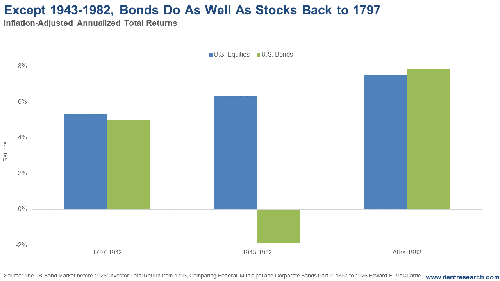

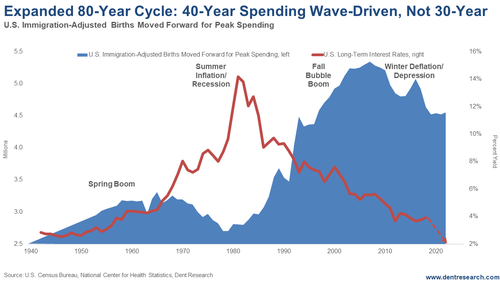

Look at the results. From 1797-1942, 145 years, stocks averaged 5.3% real returns vs. 5.1% in bonds. Given that bonds have less risk and lower volatility, that would seem to be a great deal for bonds. But there's one problem in that period: There was a long deflationary-leaning era from 1820-1942 (winter season on my 500-year Cycle) that saw much more frequent recessions/depressions and that would have caused a lot of risk in bonds from defaults as well as for stocks. And America was an emerging nation up until the early 1900s – not as stable and not the global leader. Bonds were more risky than today, even Treasury bonds. As I have said, we entered a new super-charged era after the Great Depression. The first middle class generation made people more affluent and matter more for economic cycles, i.e., the generational spending cycles that I innovated in the 1980s. These put our economy on more of a 40-year clock for booms and busts, instead of the previous 30-year commodity clock... And it set us up for stronger booms and higher inflation when the massive Baby Boom entered... And the greatest boom in history when they moved up their unprecedented Spending Wave. So, I would start here and say that the period from 1942-2019 is more relevant. This chart summarizes my breakthrough 80-Year Four-Season Economic Cycle that replaced the old 60-year Kondratieff Wave of the past – stretched and amplified in booms and inflation by these new generation cycles. (Note: See the July Leading Edge for Boom & Bust Elite subscribers.)

The red line is for inflation that drives the whole cycle. That is the Treasury bond yield cycle that I showed on Monday. The two booms and busts in blue are the projectable Spending Waves of first the Bob Hope generation after World War II and the much larger Baby Boom generation from 1983 forward. That brings us to McQuarrie's second performance bars: 1942 – 1982, those 40 years wherein bonds had -2% real returns while stocks had +6.3%. Now that's a huge divergence and down right opposite! Bonds faced the highest and longest inflation cycle in modern history driven into its peak by Baby Boom massive workforce entry. Inflation hurts bonds the most. Stocks saw a long 26-year boom that outweighed the more modest 14-year bust. Then there's that third set of bars from 1983 to 2018 that shows the highest returns for both with bonds slightly higher at 7.7% vs. 7.6% for stocks. Bonds saw the greatest disinflation cycle in history, which is king for bonds. Stocks saw the greatest boom in history and also love falling inflation. Given that bonds were less volatile, they were indeed the better deal on average – and that would be a surprise for most. But what happens when this long fall in inflation bottoms around 2022 or so by my best projections? Bonds will see an approximate 18-year bear market with rising yields, while stocks will see a boom into 2036-37 from the Millennial Spending Wave – back to opposite as is more normal. The inflation trend will be much, much milder and less harmful to bonds – but they will likely see zero or slightly negative real returns. The stock bull market will not be as long or as strong as 1983 – 2019 – we'll never see that again in developed countries. But stocks will be the place to be for more traditional 6% to 7% real returns, for the next Spring Season boom with mild inflation… But the demographics will reward you much more for being in the best aging stock sectors for the Boomers, like health care, cruise ships and nursing homes – and for being in India and Southeast Asia, the best of the demographically-strong emerging markets while developed countries continue to slow. Great study, but bad time and irrelevant time frame! You simply can't make sense out of history unless you understand the key cycles that drive it… Period!

Harry Dent Trending Stories... The real estate industry must have the best lobbyists in the country. How else can you explain that a data-driven transaction – buying or selling a home – has become more onerous, and more cumbersome. And overall more painful even as information becomes cheaper and easier to get? These guys are protecting their turf, and... Earlier this week I read a great article by Kuppy at Adventures In Capitalism. It brought back memories of the last condo and real estate bubble in Miami… I was there. I was moving to Tampa and sold before the crash that I was nearly alone in forecasting in late 2005 . Kuppy noted that prices... I'm tired of the impeachment talk and it hasn't really started yet. With the House working on impeachment inquiries in several committees, we'll get a healthy dose of political doublespeak from everyone involved for at least the rest of this year. It's already started to crowd other stories out of the news cycle. But we... Speaker of the House Nancy Pelosi sucked all the legislative air out of the room when she formally announced an impeachment inquiry against President Trump. The charge, of course, is based on a whistleblower's allegations. This is not an impeachment proceeding, which requires a vote on the floor of the House of Representatives and directs... We woke up today to find the markets in a critical place. Bitcoin has had a big fallout, the flashing lights are blinking. All the signs that we could be headed for a big fall are in effect. But there are a few current events ongoing that the markets don't seem to be accounting for... |

No comments:

Post a Comment