Tesla Bubbling Up

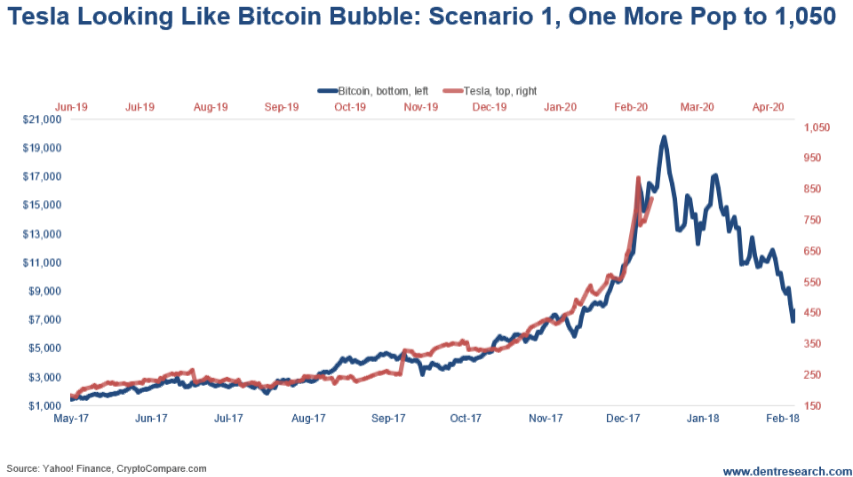

Harry Dent | February 11, 2020 | Elon Musk was looking like a crazy man in June of 2019 when Tesla (Nasdaq: TSLA) stock plunged to a low of $179. But now he's a real genius, with the stock peaking at $969 on February 4. Welcome to bubble land. This is just another sign, along with the very bubbly performance in most of the FAANG stocks, that we are in the final orgasmic blow-off phase of the broader stock and tech-driven bubble. This bubble clearly now only has months to go... not years. And these recent movements could be a sign that this bubble top is coming even sooner if the Fed's repo explosion in money printing does abate instead of continuing. Telsa dropped back just below $687 on February 6 and has been bouncing modestly since. It was up to $820 on the open this morning, but then quickly dribbled back down to $755, so no clear signs yet. Tesla is tracking the extreme Bitcoin bubble of 2017 in pattern, though not in the percentage gains, with Bitcoin up 15 times vs. Tesla's 5.5 times in a similar eight-month period. Still, the most dramatic of recent blow-off tech stock rallies.

[Click to Enlarge] This Has Never Happened in Almost 250 Years Three "spot on" predictors for the next major financial event have all come into alignment. And all signs point to what Harry Dent calls "Zero Hour" happening very soon, which could bankrupt millions of Americans nearly overnight. Click here to learn what steps you can take! Here's a second scenario showing Tesla peaking last week and bouncing a bit more before continuing down towards a $370 target.

[Click to Enlarge] In this scenario, we are bouncing into a rally that will soon fail and see those lows sooner. Right now I'm in Sun Valley speaking at the Tony Robbins Platinum conference. The first big speaker was one of my long-time favorites, Niall Ferguson, author of The Ascent of Money. I'll have more on him in Friday's rant, but he sees the China bubble as the epicenter, as I do, and he sees Tesla building a major new plant in China and targeting that as the next big market… "What could go wrong here?" he comments. It shouldn't take long to see how this plays out with the extreme movements in recent months and days, and how much it affects the broader markets… But again, another sign of the late stages of the greatest bubble in modern history right into the most important long-term cycle for stocks: The 90-Year Super Bubble/Great Reset Cycle.

Harry Dent P.S. On Tuesday, February 25th, our colleague Lance Gaitan is hold an exciting live event where he'll be revealing one the biggest investing game-changers we've seen since the Internet Revolution. You won't want to miss this. Click here to reserve your seat today! This Week in Economy & Markets... |

No comments:

Post a Comment