Asia Dominates Next Four-Season Cycle

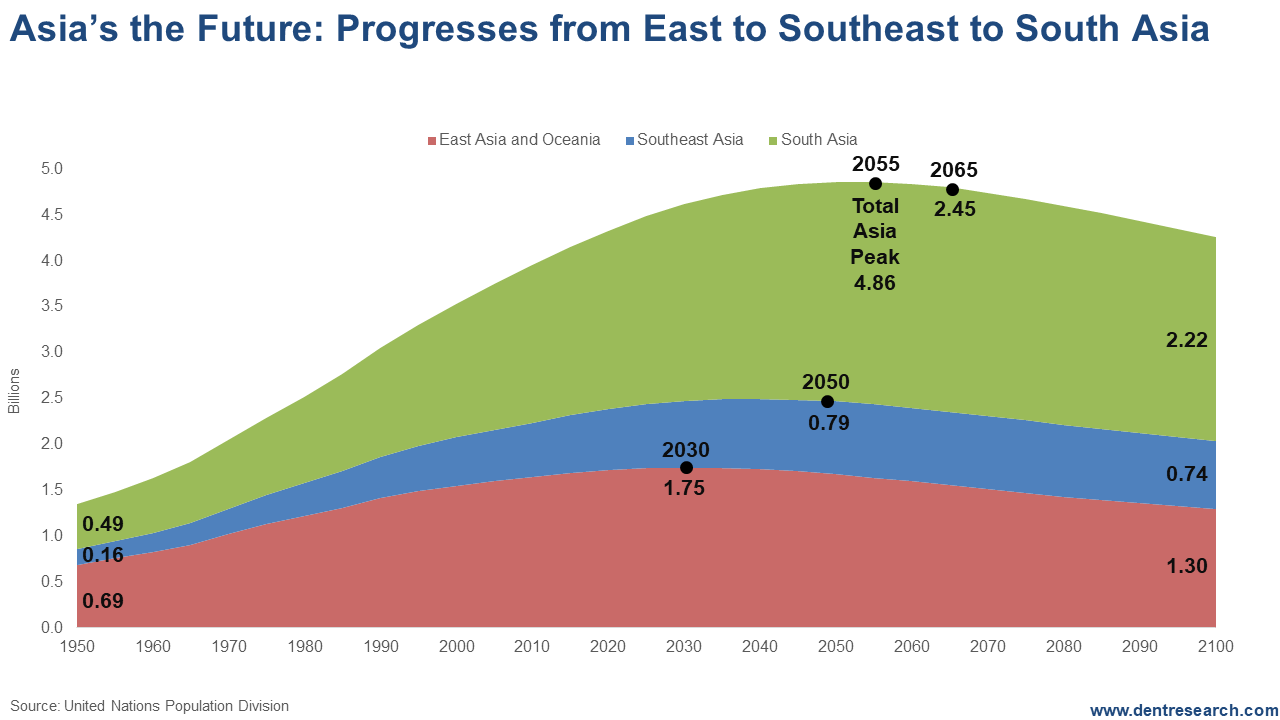

Harry Dent | December 25, 2019 | On Monday, I talked about how global growth is slowing even with the leaders of the emerging world: first China, now India. But the flip side is that Asia will be the dominant leader for the next spring boom from 2023 into 2036-37 and broader into a plateau between 2055-64 before the next winter season and global depression sets in. This trend was foretold by my 165-year East-West Cycle even before China’s massive urbanization explosion from 1985 to now, and Japan’s and other Tigers’ before in East Asia. This chart shows the three major sectors of Asia and the clear progression is from East Asia (dominated by China) to Southeast Asia to South Asia (dominated by India).

[Click to Enlarge] Note here that in 1950, East Asia was the largest region by far with 690m (million) vs. 490m in South Asia and a mere 160m in Southeast Asia. East Asia is dominated by China, but includes the Tiger countries: Japan, Hong Kong, South Korea and Taiwan. It peaks first, at 1.75b (billion) in 2030, and that’s due to China whose workforce already peaked in 2011. Southeast Asia peaks next at 790m in 2060. That includes Indonesia, the Philippines, Singapore (their original Tiger), Malaysia (late stage Tiger), Vietnam, Cambodia, Laos and Myanmar. Last comes the largest, South Asia, at 2.45b, peaking in 2065. That includes India, Pakistan and Bangladesh. India peaks in 2060, like Southeast Asia. It’s Pakistan that stretches the peak to 2065. These three sectors that largely make up Asia peak at 2055 at 4.86b, with South Asia at about half of that. Note that by 2100, South Asia at 2.22 billion is larger than East Asia (1.30b) and Southeast Asia (740m) combined. China will have fallen from a peak of 1.47b to 1.07b and India from 1.65b in 2060 down to 1.45b. India will be the largest country in the world and Pakistan fourth or fifth at 403m. Hence, South Asia will have 2 of the top 5 countries in the world. South Asia will be the largest region of Asia and the most dominant by 2065 when the next winter season sets in globally… Hence, our strategy is obvious: focus for stocks and real estate in Southeast Asia and India/South Asia for the spring and fall booms of the next four-season cycle which will be shorter than the last one, more on the historical 60-year inflation rhythm. (For more on this, see the July 2019 issue of The Leading Edge.) The next fall bubble boom will hit between 2046 and 2064, likely with a blow-off bubble between 2060 and 2064, and be focused most in India and Pakistan in South Asia.

Harry Dent Trending Stories... The central banks' job of keeping this big, fat ugly bubble going is just going to get harder. Not only are they fighting record debt and falling demographic trends in the developed world – with my hierarchy of indicators all pointing down – they are fighting record debt in the emerging world and slowing growth... Today's rant is a preview of January's Boom & Bust, which we're putting out to subscribers early this round because of the holidays beginning next week. I believe that this upcoming issue is one of the most essential and all-encompassing reports on the current financial bubble, both in terms of how we got to this... Years ago, I can remember my mom coming home from a day of shopping around the holidays and announcing that she'd saved over $600. My dad immediately asked the obvious question. How much had that savings cost? As we peruse the online and brick-and-mortar malls this last week before Christmas, we're barraged with seemingly great... How can the same houses go up far faster than inflation for decades, and that possibly be good for an economy? It only benefits older people who bought earlier, and the affluent who buy the most expensive ones that tend to bubble the most. I was just in Australia speaking to my favorite country and... I haven't worked in a traditional office in a long time. I miss some of the camaraderie, the ability to bounce ideas around, and the occasional happy hour. But I don't miss some of the personnel issues that pop up, like friction among co-workers, bad-smelling lunches wafting through the office, and the annual Secret Santa.... |

No comments:

Post a Comment